The Los Angeles multifamily market remains resilient despite economic uncertainties and natural disruptions, such as the fires in early January. Here’s an updated analysis of the city’s rental rates, vacancy trends, and property class differences, offering actionable insights for investors, landlords, and renters alike.

1. Multifamily Commercial Market Rents Overview

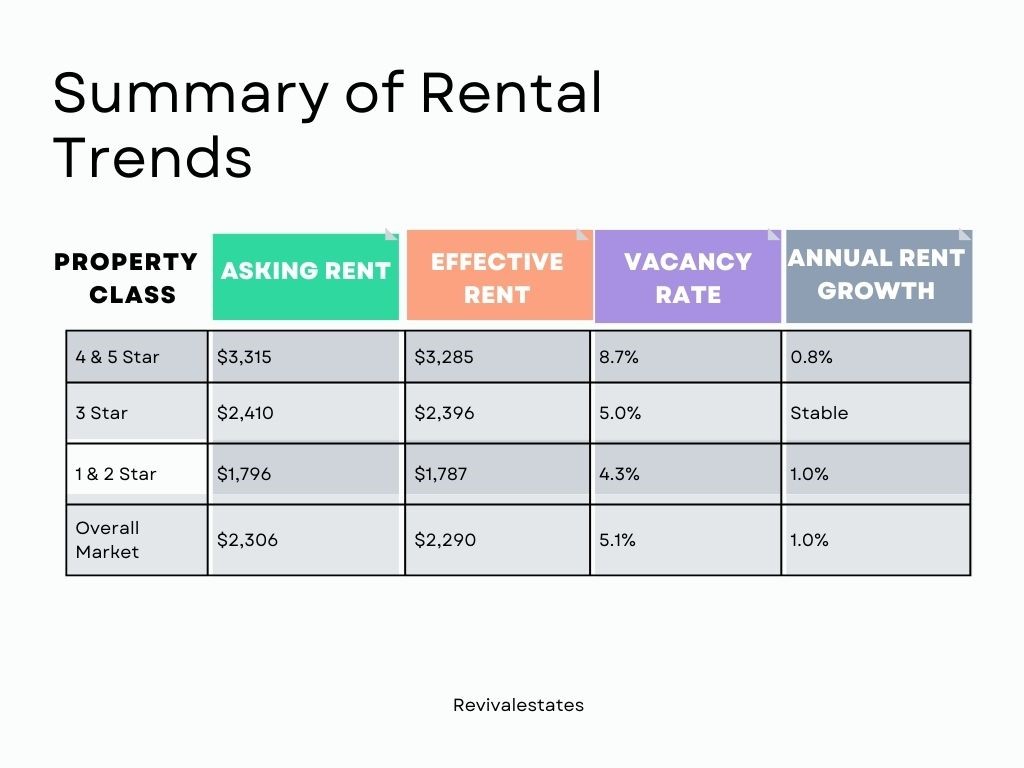

The average asking rent for multifamily units in Los Angeles stands at $2,306 per month, with an effective rent of $2,290 per month, reflecting 1.0% annual growth. While this aligns with national trends, it remains below LA’s historical average of 2.4% per year.

Key Takeaway:

Rental growth is steady but modest, with affordability concerns influencing tenant decisions. Explore the latest U.S. Census Bureau New Residential Construction Report for national housing trends.

2. Rental Rates by Property Class

The market is divided into three primary property categories, each catering to a unique segment of renters:

a. Luxury High-End (4 & 5 Star Properties)

- Asking Rent: $3,315/month

- Effective Rent: $3,285/month

- Vacancy Rate: 8.7%

Trends:

- These properties, offering amenities like fitness centers and concierge services, target high-income renters.

- High vacancy rates stem from oversupply in areas like Downtown LA and Beverly Hills.

b. Mid-Range (3 Star Properties)

- Asking Rent: $2,410/month

- Effective Rent: $2,396/month

- Vacancy Rate: 5.0%

Trends:

- These units balance affordability and amenities, appealing to working professionals.

- Stable demand with minimal new construction has maintained occupancy levels.

c. Affordable/Older Inventory (1 & 2 Star Properties)

- Asking Rent: $1,796/month

- Effective Rent: $1,787/month

- Vacancy Rate: 4.3%

Trends:

- Budget-conscious renters, including students and retirees, dominate this segment.

- Demand remains high due to affordability concerns, but rent growth is stagnant at 1.0%.

3. Vacancy Rate Analysis

Los Angeles’ overall vacancy rate is 5.1%, with notable variations across property classes and submarkets:

- 4 & 5 Star Properties: 8.7% (driven by oversupply and economic constraints).

- 3 Star Properties: 5.0% (balanced demand and stable absorption).

- 1 & 2 Star Properties: 4.3% (reflecting strong demand for affordable housing).

Submarket Highlights:

- San Fernando Valley: Tight vacancy rates (~4%), rents ranging from $1,700-$2,200/month.

- Downtown LA: Higher vacancy rates (~7%) due to new luxury developments.

- South Los Angeles: Low vacancy rates (~2.5-3.5%), offering affordability.

- Beverly Hills: High vacancy (~7.5%) due to premium pricing and limited tenant affordability.

For insights into absorption rates and demand, check out the HUD Survey of Market Absorption of New Multifamily Units.

4. Submarket Performance and Trends

High-Performing Submarkets

- South Los Angeles: Moderate rent growth (2-3% annually) with low new construction.

- North San Fernando Valley: Consistent demand for affordable options.

Challenged Submarkets

- Downtown LA: Rent averages $2,800/month but faces sluggish demand due to competition from new luxury units.

- Koreatown: Rents declined by -1%, reflecting higher vacancies (~6%) from increased supply.

5. Market Outlook and Projections

The market is poised for steady improvement through 2025:

- Vacancy Rates: Projected to decline to 4.8% by late 2025 due to reduced new supply.

- Rent Growth: Expected to accelerate beyond 3% in mid-2025, particularly in mid-range and affordable segments.

- New Construction: Slowing due to regulatory hurdles and high financing costs, benefiting existing properties.

6. Factors Influencing Market Dynamics

Economic Conditions

- Job losses in entertainment and tech sectors limit high-end rental demand.

- Economic uncertainty drives migration out of Los Angeles.

Affordability Challenges

- Rising living costs push lower- and middle-income renters toward affordable housing.

Natural Disasters

- Fires in areas like Pacific Palisades displaced homeowners, increasing short-term rental demand.

For more on housing and affordability, visit the California Department of Housing and Community Development.

Seizing Opportunities in 2025

The Los Angeles multifamily market is stable but faces challenges from oversupply in luxury properties and economic pressures. However, mid-range and affordable housing segments continue to show strong demand, making them ideal for long-term investment.

Looking ahead, declining vacancy rates and accelerating rent growth by late 2025 offer promising opportunities. Investors and landlords should focus on high-demand submarkets like South LA and North San Fernando Valley while monitoring regulatory and economic shifts.

“Get expert guidance to navigate these trends—let Revival Estates simplify the process and help you achieve your goals today!”